Live your BEST life

Collegiate Checking is packed with features and resources designed to give your finances a glow-up.

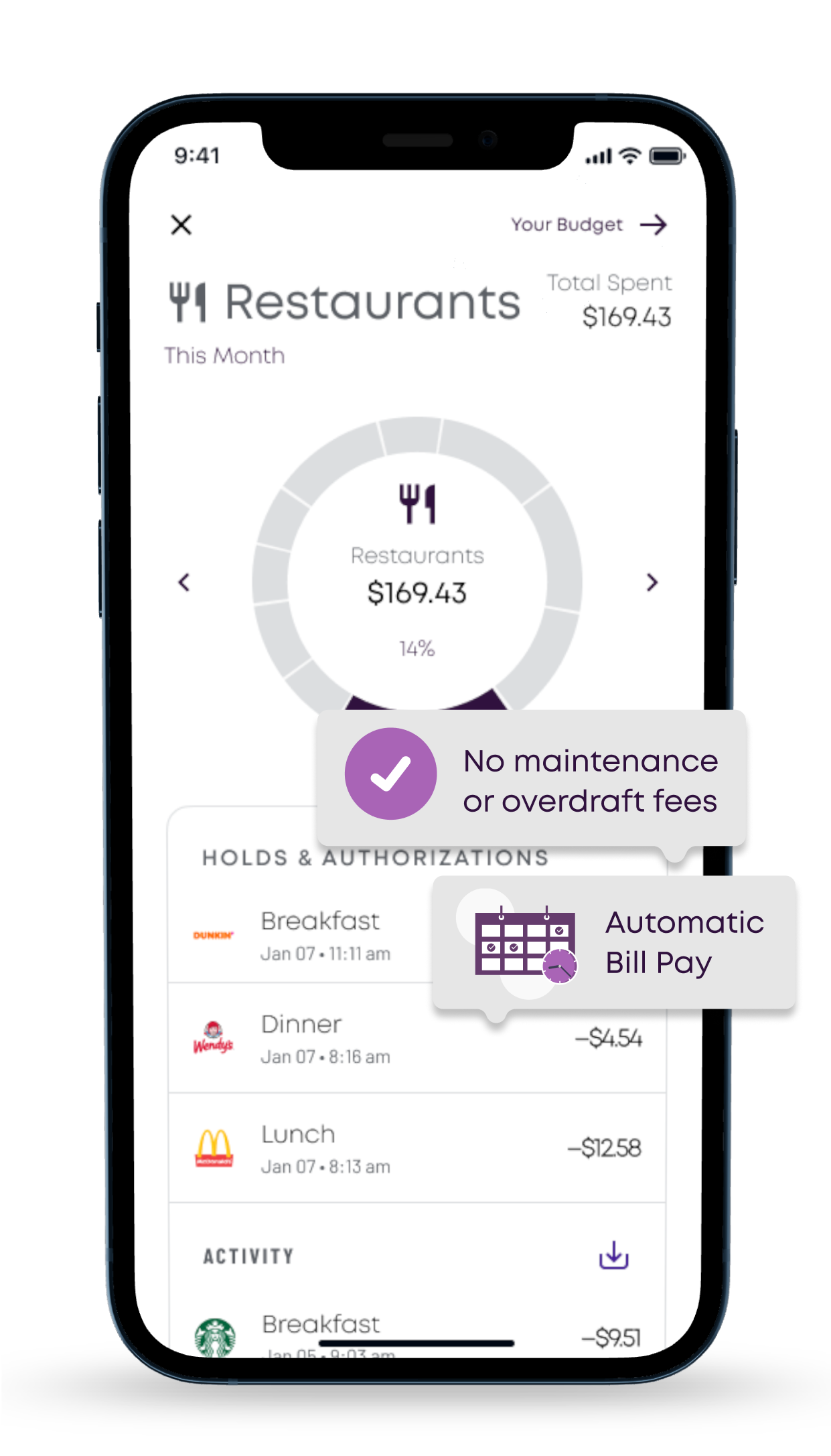

- Control your finances with spending insights.

- Split bills with friends.

- Get FREE financial content from FinStart.

What could you do with an extra $180 a year?*

Not to put anyone on blast, but some banks charge a ton of fees just to hold your money for you. Keep more of your money with you when you open your Collegiate account.

- No monthly service fees

- No overdraft fees

- 30,000+ surcharge-free CO-OP Network ATMs

*Survey: ATM fees hit record high while overdraft and NSF fees fell sharply. Bankrate, Aug. 21, 2024.

Why bank with a credit union?

Collegiate Credit Union

Traditional Banks

Profitability

Non-profit. Profits are returned to members like you through better rates and less fees.

Banks are privately owned or publicly traded.

Fees

No monthly service fees and no overdraft fees.

Record high fees* in 2024.

Vibes

Empowering and purpose-driven.

Corporate and transactional.

Join Collegiate today through the Desk Drawer Foundation—our organization that offers grants and donations to nonprofits in our local communities! For a limited time, we’ll donate $10 on your behalf!

Why bank with a credit union?

Collegiate Credit Union

Profitability

Non-profit. Profits are returned to members like you through better rates and less fees.

Fees

No monthly service fees and no overdraft fees.

Vibes

Empowering and purpose-driven.

Traditional Banks

Profitability

Banks are privately owned or publicly traded.

Fees

Record high fees* in 2024.

Vibes

Corporate and transactional.

Join Collegiate today through the Desk Drawer Foundation—our organization that offers grants and donations to nonprofits in our local communities!

For a limited time, we’ll donate $10 on your behalf!

Collegiate is a custom digital credit union created by Michigan State University Federal Credit Union. Conditions for cash back and round-up features will be available at account opening. Funds are insured up to $250,000 through MSUFCU, member NCUA.

Copyright © 2024 Collegiate, a trade name of Michigan State University Federal Credit Union. All rights reserved.

If you are using a screen reader or other auxiliary aid and are having problems using this website, please call (844) 201-9519 for assistance.

*Annual Percentage Yield (“APY”) means a percentage rate reflecting the total amount of dividends paid on an account, based on the dividend rate and the frequency of compounding for a 365-day period. This rate assumes that a set amount is on deposit at the beginning of the dividend period, no deposits or withdrawals are made during the dividend period, and funds remain on deposit for one full year at the same dividend rate. Fees may reduce earnings. Rates for accounts are variable and may change.

Collegiate Credit Union accounts are held at Michigan State University Federal Credit Union where savings are federally insured to at least $250,000 by the NCUA and backed by the full faith and credit of the United States Government. APY = Annual Percentage Yield. View our Privacy Policy and read our disclaimer regarding links to other sites.